There’s always something changing in the world of tax, especially sales tax. Here’s a review of some of the recent changes and updates, with a special focus this month on how more states and jurisdictions look to roll back sales tax.

3 min read

What’s new in state sales and use taxes

By Robert Dumas on Tue, Mar 15, 2022 @ 11:15 AM

Topics: sales tax nexus sales tax compliance economic nexus

5 min read

Do you really understand economic nexus for sales tax?

By Robert Dumas on Thu, Mar 10, 2022 @ 11:15 AM

Businesses have heard a lot about economic nexus over the past few years. But what exactly is economic nexus – and, more importantly, have you kept up with its constant changes in the sales tax realm?

Topics: sales tax nexus sales tax compliance economic nexus

5 min read

Understanding the Pieces to Your Sales Tax Compliance Puzzle

By Robert Dumas on Thu, Feb 10, 2022 @ 11:00 AM

This article was written for the Atlanta Business Chronicle Leadership Trust. To see the original post, click here.

In a little more than three years since the Supreme Court’s Wayfair decision, multi-state sales tax has gone from a simple obligation for some companies that were based solely in one state to a nightmare of complying with 50 different states’ sales tax rules.

Topics: sales tax nexus sales tax compliance

4 min read

2021: The Year in Review – Sales Tax

By Robert Dumas on Thu, Dec 30, 2021 @ 11:00 AM

The whole world pinballed throughout a pandemic the last two years and continues to do so. Sales tax in 2021, though, seemed to move in only one direction: It intensified as even more states hopped on the economic nexus bandwagon and the sales tax burden for online businesses grew.

Topics: sales tax nexus sales tax compliance sales tax news

3 min read

Holiday Sales, Increased eCommerce Activity - and Sales Tax Obligations

By Robert Dumas on Tue, Dec 28, 2021 @ 11:00 AM

It looks like another banner year for eCommerce and online shopping this holiday season. And that means that more companies may find themselves with new sales tax obligations.

Topics: sales tax nexus sales tax compliance

4 min read

Top Skills Needed to Manage Sales Tax

By Robert Dumas on Thu, Oct 14, 2021 @ 11:00 AM

The majority of businesses still manage their sales tax obligations with internal staff, but do they have what it takes to manage sales tax effectively?

Topics: sales tax nexus sales tax compliance

4 min read

NOMAD States: The Latest on Sales Tax

By Robert Dumas on Tue, Oct 12, 2021 @ 11:00 AM

NOMAD and sales tax – I’m sure you’ve heard it before. But what does it mean?

Topics: sales tax nexus sales tax compliance

3 min read

Monthly State Sales and Use Tax Update

By Robert Dumas on Thu, Oct 07, 2021 @ 11:00 AM

There’s always something changing in the world of tax, especially sales tax. Here’s a review of some of the recent changes and updates.

Topics: sales tax nexus sales tax compliance

2 min read

Missouri Inches Toward Economic Nexus

By Robert Dumas on Thu, Jun 24, 2021 @ 11:00 AM

A bill to enact economic nexus requirements – creating a sales and use tax obligation on remote sellers and marketplace facilitators – awaits only a signature to become law in Missouri.

Topics: sales tax nexus sales tax news south dakota vs. wayfair

5 min read

South Dakota Vs. Wayfair: Case Brief & Decision Summary

By Robert Dumas on Tue, Jun 22, 2021 @ 11:00 AM

June 21 marked three years since the landmark decision in the South Dakota v. Wayfair case. The years since June 2018 have been unlike anything in the history of sales tax.

Topics: sales tax nexus south dakota vs. wayfair

4 min read

Questions to Ask Your Sales Tax Provider Before You Sign the Contract

By Robert Dumas on Tue, Jun 15, 2021 @ 11:00 AM

They said it would be simple. They said they could automate it all, but in fact, you’re still doing a lot of the work. Why are you paying more penalties for missed notices and late payments than you were before you started working with your sales tax vendor? Guess what – we frequently hear these situations from businesses ready to make a switch. The good news is there are other providers that put the client first and ensure sales tax is managed correctly. You just have to know what to ask when investigating your potential provider.

Topics: sales tax nexus sales tax compliance

7 min read

5 Steps to Tracking Your Economic Nexus Footprint

By Robert Dumas on Thu, Jun 10, 2021 @ 11:00 AM

Your sales tax obligations start with whether or not you have sales tax nexus. Without it, you have no obligation to collect and remit sales tax to specific taxing states or jurisdictions. Your sales tax nexus is determined by either a physical or economic presence within a taxing jurisdiction.

Topics: sales tax nexus sales tax compliance

5 min read

Unexpected Growth Can Mean Sales Tax Obligations

By Robert Dumas on Tue, May 04, 2021 @ 11:00 AM

This article was written for the Atlanta Business Chronicle Leadership Trust. To see the original post, click here.

Every business owner wants their company to grow. And when that growth is unexpected, it feels that much sweeter. But don’t forget that success that comes from selling into more states can also expand your sales tax burdens.

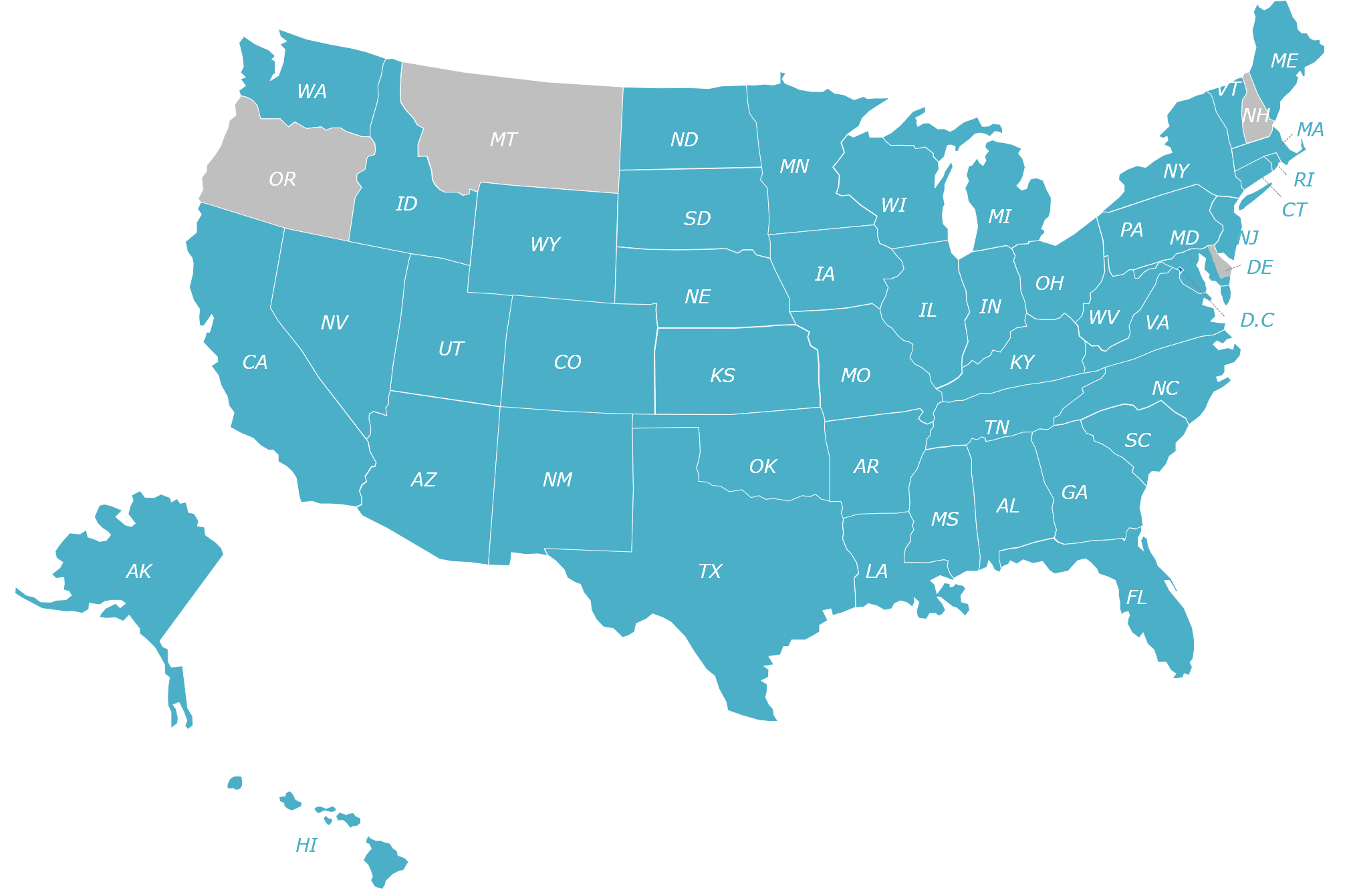

Businesses that sell into multiple states or jurisdictions have to pay attention to sales tax thresholds, and it’s not a one-time project. Almost all states and more than a few localities have enacted some form of economic presence as a way to enforce sales tax obligations ever since the 2018 Supreme Court Wayfair decision. Businesses must also be aware of triggering the obligation to collect and remit sales tax due to a physical presence. A physical presence is often seen as your physical office location but can be determined by where your inventory is stored, where employees work or where third-party contractors are utilized, among other criteria.

Having either a physical presence or an economic presence can lead to sales tax nexus, or the connection a business has with a state or taxing jurisdiction. Nexus can happen quickly (or over time) and for a variety of reasons.

Ways of creating a sales tax obligation

In the United States, a business’s obligation to collect and remit sales tax starts with nexus. Sales tax nexus can be categorized into economic or physical.

Economic nexus requires remote sellers that may not have previously had a physical presence to collect sales tax because they’ve reached state and jurisdiction revenue thresholds or reached certain transaction thresholds. In South Dakota, for instance, the revenue threshold is $100,000 in sales or 200 transactions in the previous or current calendar year. Many states mirror these same thresholds, while other states set their own parameters. Florida and Missouri have not implemented any economic nexus standards — but stay tuned as each state is considering options.

Physical nexus means a business has a direct connection to a state. Most often this happens when a business operates out of a brick-and-mortar location in a tax jurisdiction. Other activities that can create a physical presence/nexus include employees or offices in a state, sales reps or agents visiting a state, delivery vehicles or maintenance or repair services in a state, attending trade shows in a new state, or inventory stored in a state.

Topics: sales tax nexus sales tax

5 min read

3 Common Missteps of Sales Tax

By Robert Dumas on Tue, Apr 27, 2021 @ 11:00 AM

Sales tax obligations are getting more complicated for businesses of all industries. And it takes just a few mistakes to add up to a big liability and hefty fees. In this blog, we’ll talk to some of the common missteps businesses make when trying to manage sales tax on their own.

Topics: sales tax nexus sales tax news

4 min read

Add Florida to the List of States with Economic Nexus!

By Robert Dumas on Thu, Apr 22, 2021 @ 11:00 AM

Topics: sales tax nexus sales tax news

4 min read

Overlooked Aspects of Your Compliance Process

By Robert Dumas on Tue, Mar 30, 2021 @ 11:00 AM

When you think about tax compliance, of any kind, the first thing that comes to mind is filing, or even the tax return itself. Compliance with sales tax goes way beyond that.

.png?width=1200&height=628&name=2023%20logo%20with%20SOC%20and%20clearly%20rated%20(2).png)