Sales Tax Scaries 4: Nexus and Taxability

When Sales Tax Creeps Up on You

Ever notice how the first characters in every horror movie never...

NOMAD and sales tax – I’m sure you’ve heard it before. But what does it mean?

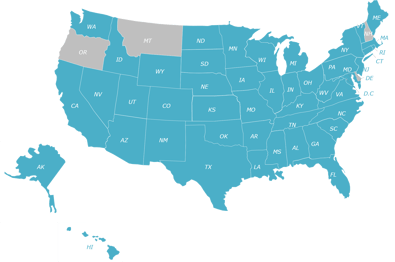

When it relates to sales tax, the NOMAD states refer to the five American states that don't have a statewide sales tax: New Hampshire, Oregon, Montana, Alaska, and Delaware. When named in that order they make up an acronym lover’s dream: “NOMAD.”

While most of the country is accustomed to the idea of a sales tax, this handful of states don’t impose this tax on their residents (at least at the state level). Some laws within those states allow for local governments to collect a sales tax if they so choose – and boy, do they choose – but by and large these states are sales tax-free.

“By and large,” of course, doesn’t mean “always,” and nothing remains the same for long in sales tax these days. The NOMADs bear watching for changes in how they handle sales tax.

New Hampshire: “Tax-free” doesn’t precisely describe the Granite State, as property taxes are some of the highest in the country, but for sales tax, they currently impose no sales tax affecting businesses at the state or local level. (There are excise taxes on certain services, but as we previously mentioned in a recent blog, sales tax and excise tax are two different items.)

Regarding sales taxes, there are still none affecting businesses at the state or local level; excise taxes are levied on some services. In fact, New Hampshire lawmakers were and remain aggressive about counteracting the Supreme Court’s 2018 Wayfair decision and sales tax obligations for online sellers.

Oregon: There is still no state-wide sales tax in the state, but cities are allowed to impose their own sales taxes in certain situations. For the most part though, businesses in Oregon do not have to worry about the management of sales tax for in-state purchases.

Montana: With no statewide sales tax, Montana also allows localities to assess sales tax, but these are small, tourist-destination cities that charge sales and use tax on items and services not usually sold online.

Out-of-state businesses with nexus in Montana may be required to obtain a seller’s permit and to charge, collect and remit local taxes. The state maintains a questionnaire to help determine if a business has nexus in Montana.

Locally in the state, Missoula is toying with a 3% sales tax on marijuana.

Alaska: Soon the acronym might be “NOMD”: Alaska seems to be inching toward a statewide sales tax.

Many local jurisdictions in the state have long enforced sales tax collection if a business had a physical presence. Recently, local jurisdictions formed the Alaska Remote Seller Sales Tax Commission to unify and ramp up sales tax collection and remittance. The Commission claims that almost all of this state’s 112 local taxing jurisdictions may soon be members.

That’s not all. Alaska Gov. Mike Dunleavy has said he’d support a statewide sales tax. A bill that would adopt a 2% state sales and use tax and enter the Streamlined Sales and Use Tax Agreement is making its way through Juneau. Stay tuned.

Delaware: No state sales tax, but Delaware does require certain businesses and sellers to pay a gross receipts tax that varies based on business activity.

Sales of goods are subject to Delaware gross receipts tax as a wholesale sale (where the goods are re-sold) or as a retail sale (where the goods are consumed by the purchaser). Wholesale sales are based on destinations within the state and retail sales on the passage of title within Delaware. Again, these taxes are often handled very differently than sales tax and therefore it is still considered a sales tax-free state.

These 5 states sound like a great place to avoid sales tax obligations for your business, but for most businesses, the goal is to not just sell in their home state. Businesses based in these states still have the obligation to track their nexus footprint outside of their state and manage sales tax where they’ve determined they have an obligation. If you are selling into one of these states, you most likely will reap the benefits of not having to collect and remit sales tax from these customers.

Sales tax isn’t getting any easier. Let TaxConnex manage the burden of keeping up with all the changes and challenges that come with staying compliant in this post-Wayfair world. Contact us to learn what it means when sales tax compliance is all on us. Click here to learn more about Economic Nexus Laws By State

Ever notice how the first characters in every horror movie never...

Copyright © 2025 TaxConnex, LLC