Sales Tax Scaries 4: Nexus and Taxability

When Sales Tax Creeps Up on You

Ever notice how the first characters in every horror movie never...

Having a full understanding of your sales tax obligations is important for your peace of mind. But, like most things in sales tax, this is easier said than done. It’s difficult enough to keep up with the different economic nexus thresholds per state, but for some states, the revenue thresholds are based on gross sales, and in other states, they are based on taxable sales.

Understanding if your products and/or services are taxable is part of the equation. You also need to be aware of whether your customers are exempt. In states where only taxable sales are used to determine economic nexus both of the above are important factors.

The basic rules

Economic nexus requires remote sellers that may not have previously had a physical presence to collect sales tax because they reach certain set thresholds for state and jurisdiction revenue. For example, in South Dakota – where economic nexus really all started with the 2018 Supreme Court Wayfair decision – the revenue threshold is $100,000 in sales or 200 transactions in the previous or current calendar year. Remote sellers who sell above those quantities in South Dakota must collect sales tax and remit it to the state.

Forty-four states (Counting Florida, starting in July) and the District of Columbia (with more likely on the way) enforce economic nexus. Many states roughly mirror South Dakota’s threshold. Other states set their own parameters – and one of those parameters can involve including sales of items exempt from sales tax.

In general, exemptions are statutory exceptions eliminating the need for the retailer to collect sales tax on a particular transaction or on all transactions with a customer. The most common exemption is a “sale for resale,” which allows retailers to purchase products from wholesalers free of tax.

So what do states use?

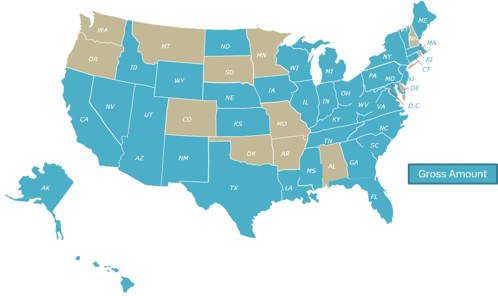

The majority of states determine their threshold numbers by gross taxable sales. This means the gross receipts for all revenue sources, whether they are taxable or not. However, this is not the case for all states. Ensure you know which states they are and that you will have to calculate them differently than the rest. And be sure to check frequently, as rules often change.

Refer to the map below for specifics as of April 2021:

Your best defense is to check with individual states where you have or will soon trigger economic nexus. And understand where your products and services are taxable too. Nexus only helps you understand where you may have a sales tax obligation. You may have sales tax nexus, but if your products or services are either non-taxable or exempt then you do not need to collect sales tax.

If you need help understanding your sales tax obligations and whether your products and/or services are taxable within the states you are doing business – get in touch. TaxConnex has experts to help answer these questions for you and to help you establish an ongoing process to ensure you remain compliant, even with the frequently changing rules of sales and use tax.

Ever notice how the first characters in every horror movie never...

Copyright © 2025 TaxConnex, LLC