Sales Tax Scaries 4: Nexus and Taxability

When Sales Tax Creeps Up on You

Ever notice how the first characters in every horror movie never...

To help financial leaders better understand what their peers are doing when it comes to sales and use tax in 2024, TaxConnex® conducted its fourth annual sales tax survey in November of 2023. More than 100 financial leaders from different industries and from a wide range of sizes responded. Their responses are included in the following blog.

For the vast majority of organizations, managing the minutia of sales tax obligations can be described as clunky, cumbersome, and risky, with each state having its own rules that are constantly changing.

The myriad of approaches and solutions available to address these problems is just as fragmented as the states’ rules themselves.

For those who rely on internal resources to manage these functions themselves, which represents 50% of survey respondents, it requires highly specialized resources who are knowledgeable about sales tax obligations and have the time to keep up with the changing regulations across multiple states. These resources are hard to attract and retain these days, according to 62% of respondents.

The impact of not having the right resources in place is real and can be felt in many ways:

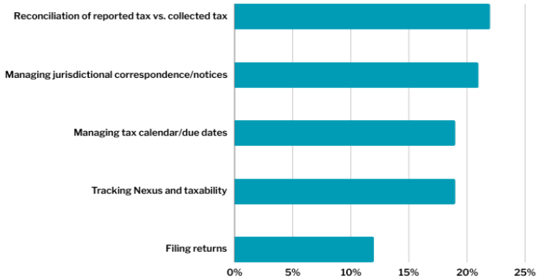

As an alternative to leveraging their own internal resources, 41% of companies have chosen to use sales tax software applications in an attempt to automate the many complex rules and deadlines. The idea of automation sounds good, but among those who use software, many of the systems are missing key automation capabilities, including:

(Q: Which of the following functions are not fully automated or addressed by your automated software)

At the heart of what organizations are really looking for is to get the work done in the most efficient and effective manner. This doesn’t have to be through automation, even with AI being the buzzword it is in the last few years, automation typically comes top of mind. However, could outsourcing to a responsible party have the same, if not better results? Outsourcing to a firm that specializes in sales tax management typically offers a more complete solution, reducing the amount of work internal teams have to perform and oversee.

If you’re struggling with how to manage sales tax in 2024, consider outsourcing. TaxConnex acts as an outsourced member of your team, getting to know your business and processes while apply sales tax expertise and years of experience into a compliance process that works for you. Get in touch to learn more!

Looking to learn more about the responses we received from our 4th annual sales tax survey? Download our eBook:

Ever notice how the first characters in every horror movie never...

Copyright © 2025 TaxConnex, LLC