Sales Tax Scaries 4: Nexus and Taxability

When Sales Tax Creeps Up on You

Ever notice how the first characters in every horror movie never...

Sales and use tax nexus is a connection between a person or entity and a taxing jurisdiction. Sales tax nexus is the basis for all your sales tax decisions because without sales tax nexus you have no further obligation to a state. If you do have sales tax nexus, then you need to dig a bit deeper. But what exactly defines when you have sales tax nexus?

From a sales tax perspective, it is either a physical or economic presence. There are some obvious examples of physical presence include an office or an employee in a state. However, don’t be fooled by the lack of this true physical presence. States can also assert sales tax nexus if you travel into their state, exhibit at trade shows, or even use independent contractors to solicit business or provide some type of service to your end customer.

Consider these common business activities that can create physical tax nexus:

The introduction of Economic Nexus

In 2018, South Dakota vs Wayfair, Inc. led to the largest change in sales tax in the last 50 years, redefining nexus as a certain amount of sales and/or a certain number of transactions in a state or jurisdiction. This is now referred to as economic nexus.

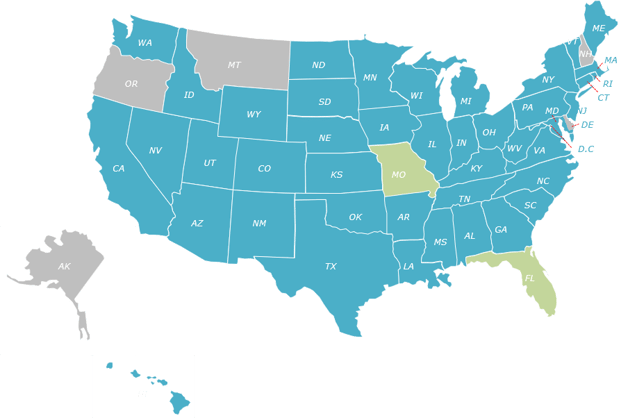

Almost all states have adopted some form of economic nexus that requires an out-of-state business to collect and remit sales tax. (As of December 2019 – only Missouri and Florida have not adopted economic nexus rules).

These obligations potentially affect many industries, and may mean that a company does not have any physical presence but if their sales revenue and/or number of sales transactions exceeds a certain threshold over a one year period of time, then the state will assert sales tax nexus and require the business to collect the applicable sales tax.

It is important to understand when you have nexus, both physical and economic, but states have not made this an easy process. Nexus standards are frequently changing and evolving and can be quite a pain to keep up with.

Want to learn more? Download our new eBook – The Guide to Getting Sales Tax Right for all you need to know to keep your business sales tax compliant.

Ever notice how the first characters in every horror movie never...

Copyright © 2025 TaxConnex, LLC