Sales Tax Scaries 4: Nexus and Taxability

When Sales Tax Creeps Up on You

Ever notice how the first characters in every horror movie never...

Drop shipments are more prevalent in today’s marketplace than most realize –many purchases made online today are commonly drop-shipped to consumers, transactions that typically involve multiple states and parties. Navigating the application of sales and use taxes and related exemptions in a drop shipment scenario is tricky for both the retailer and the drop-shipper.

Many companies now have marketplaces on websites for taking orders and making retail sales of tangible personal property without maintaining any inventory. Instead, they are leveraging other suppliers/distributors who “drop-ship” the product directly to the customer.

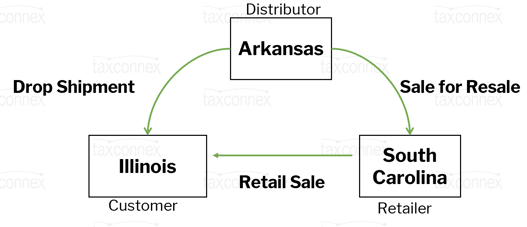

For example, a retailer based in South Carolina sells a baseball cap through its website to a customer located in Illinois. The South Carolina retailer purchases the baseball cap from a distributor located in Arkansas and instructs the distributor to ship the baseball cap directly to the customer located in Illinois. For purposes of this example, assume the Arkansas distributor has “nexus” and is registered for sales and use tax purposes in Illinois and the South Carolina retailer does not have nexus in Illinois and nor is it registered for Illinois sales and use tax purposes. The South Carolina retailer is only registered in the state of South Carolina for sales and use tax purposes.

From the distributor’s perspective, this transaction is a single sale to the South Carolina retailer where the situs of the transaction for sales and use tax purposes is in Illinois (the ship-to location). The Arkansas distributor will be required to charge Illinois use tax on the sale to the retailer unless the retailer can present the distributor with a valid resale exemption certificate.

“Nexus” refers to a connection between a company or a person and a taxing authority or a jurisdiction. Most recently, the U.S. Supreme Court determined in South Dakota v. Wayfair, Inc. et al that an out-of-state seller could establish “nexus” through economic activity alone and that physical presence is not required to create nexus.

As a result of this economic nexus standard for sales and use tax purposes, more distributors and retailers than ever are impacted by drop shipment transactions. Generally, sales and use tax situs is based on the ship-to location: When anyone has nexus in a jurisdiction and ships tangible personal property into that jurisdiction, they are required to comply with sales and use tax laws of that state.

In our example above, the Arkansas distributor is required to charge Illinois use tax to the South Carolina retailer; the laws in Illinois require that a valid Illinois resale certificate be issued by the retailer to the distributor in order for the transaction to be exempt from the Illinois use tax. Since the South Carolina retailer is not registered in Illinois for sales and use tax purposes, it is unable to issue a valid Illinois resale certificate. The South Carolina retailer is faced with a decision – either pay the Illinois use tax to the distributor, eating into their profit margin; or, register in Illinois for sales and use tax purposes and charge tax on all its sales to Illinois customers. Even if the South Carolina retailer opts to pay the Illinois use tax to the distributor, the Illinois customer will have an additional use tax liability directly to the state of Illinois on the purchase price of the baseball cap.

But not all states require the same level of documentation to substantiate and exempt sale for resale as Illinois. Using the example above, if we removed Illinois and inserted the state of Georgia and all other facts remained constant, the South Carolina retailer could have issued to the distributer a Georgia resale certificate with their South Carolina sales and use tax registration number listed on it to exempt this transaction from Georgia use tax. The customer would be responsible for remitting the Georgia use tax directly to the state.

Executing within the requirements for exempt or reselling status in a drop shipment transaction can be complicated and burdensome for both the retailer and the distributor. (Check out the drop-shipment survey from the Institute for Professionals in Taxation for more in-depth in formation.)

For more, watch the replay from this month’s TaxConnex webinar, “Navigating Sale/Use Tax Implications of Drop Shipments,” with Jeff Meigs, TaxConnex partner and consulting practice leader.

Ever notice how the first characters in every horror movie never...

Copyright © 2025 TaxConnex, LLC