Sales Tax Scaries 4: Nexus and Taxability

When Sales Tax Creeps Up on You

Ever notice how the first characters in every horror movie never...

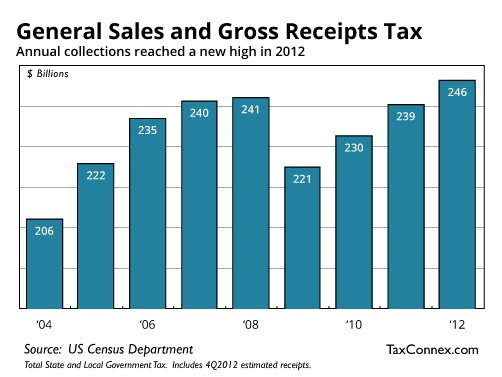

For the calendar year 2012, state and local governments are expected to collect $246 billion in general sales and gross receipts taxes. That's a new record - a $7 billion increase over the prior 12 month collections.

With everything you hear about sales tax nexus, Amazon Laws, The Main Street Fairness and Marketplace Equity Acts, you might think that sales taxes are declining and that state and local governments are struggling to collect revenue. That's just not the case.

TaxConnex is in the business of providing sales tax outsourcing and sales tax consulting - we're not economists. But, some quick "back of the envelop analysis" makes us believe that the next twelve months will show significant gains for state general sales and gross receipts tax collections.

Why? As more people return to work, spending will rise and so will sales taxes. However, the unexpected drop in revenues in 2009 really caught the attention of the states, leading them to pass new laws. These new laws broaden the taxability of goods and services and placed a spotlight on internet sales. More people buying more taxable goods through more channels (including the internet) lead to soaring sales tax collections for the states.

We'll keep an eye on these collections in 2013, and you should too. We’re expecting a boom in sales tax collections.

For businesses, this leads to increased compliance risk as the jurisdictions enact new laws and increase enforcement efforts. Stay diligent.

Tags:

sales tax nexus, sales tax compliance, sales tax, sales tax audits, sales tax news, sales tax filing

Ever notice how the first characters in every horror movie never...

Copyright © 2025 TaxConnex, LLC