Sales Tax Scaries 4: Nexus and Taxability

When Sales Tax Creeps Up on You

Ever notice how the first characters in every horror movie never...

I had a sales call this week with a very experienced CFO for a group of start-up technology companies. Over the course of the last couple of years, this CFO became aware of sales tax responsibilities for some of his companies and had begun building processes to identify prior period exposure and to manage the prospective sales tax compliance process.

He had already engaged a firm to do a nexus review of his companies, so he was starting at the right step in the process. Though he still has to determine the prior period exposure, he also recognizes that he needs to begin thinking about the process necessary for charging his customers sales tax and paying the taxes. In his research for this process, he found sales tax technology companies that will provide a tax calculation engine that includes taxability decisions and tax rates.

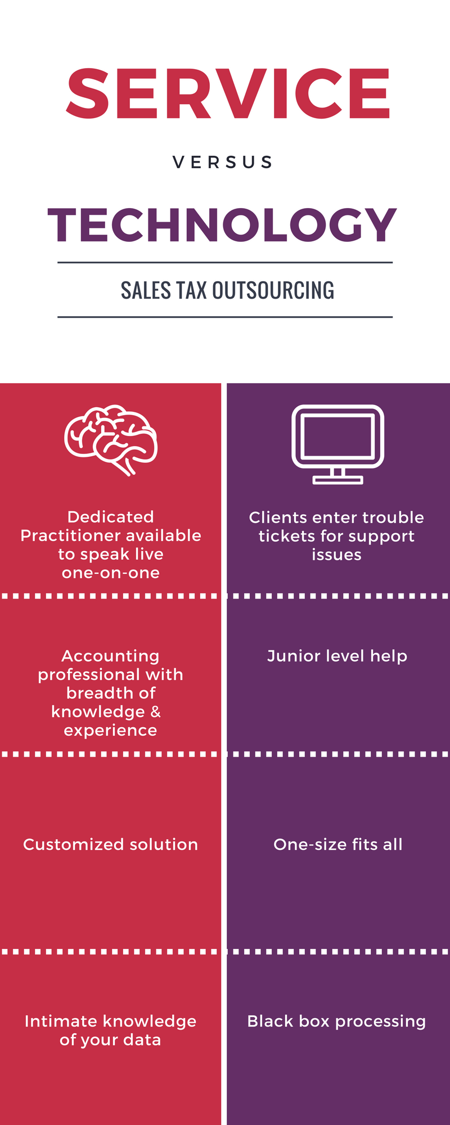

Basically, he was attempting to solve his sales tax problems with technology only. This certainly makes sense from his perspective, but it is not accurate. I had to explain the many elements of sales tax compliance that require professional services as a necessary supplement to the good technology solutions.

Because the CFO had no experience with sales tax compliance, he did not understand he needed a ‘head count’ – or portion thereof – to oversee the prospective sales tax compliance process.

I value the technology. It is a critical component of any sales tax compliance process. As you can expect, I also value the professional services that must be part of the process as well. Please don’t let anyone sell you a ‘technology only’ process unless you are fully aware of the potential holes and risk to the business. By the way…I was successful getting the CFO to understand…no deal yet though!

Ever notice how the first characters in every horror movie never...

Copyright © 2025 TaxConnex, LLC