Sales Tax Scaries 4: Nexus and Taxability

When Sales Tax Creeps Up on You

Ever notice how the first characters in every horror movie never...

Be afraid of a sales tax compliance solution that promises “easy” and “push button simplicity”. Because of the complexities surrounding sales tax compliance, business owners and finance leaders want to hear there’s an easy answer to automate their sales tax compliance. These business owners and finance leaders talk with different companies involved in the sales tax compliance industry and oftentimes buy from whomever promises what they want – ease and simplicity. However, it’s not always that simple.

I divide sales tax compliance into two distinct functions – (1) Calculating the applicable sales tax and adding the sales tax to an invoice; and (2) Making sales tax decisions including nexus decisions, where and when, and how to file sales tax returns, and managing day-to-day sales tax questions. Technology is most valuable in calculating the applicable sales tax. But be wary of a sales tax technology-first solution where decision-making is required.

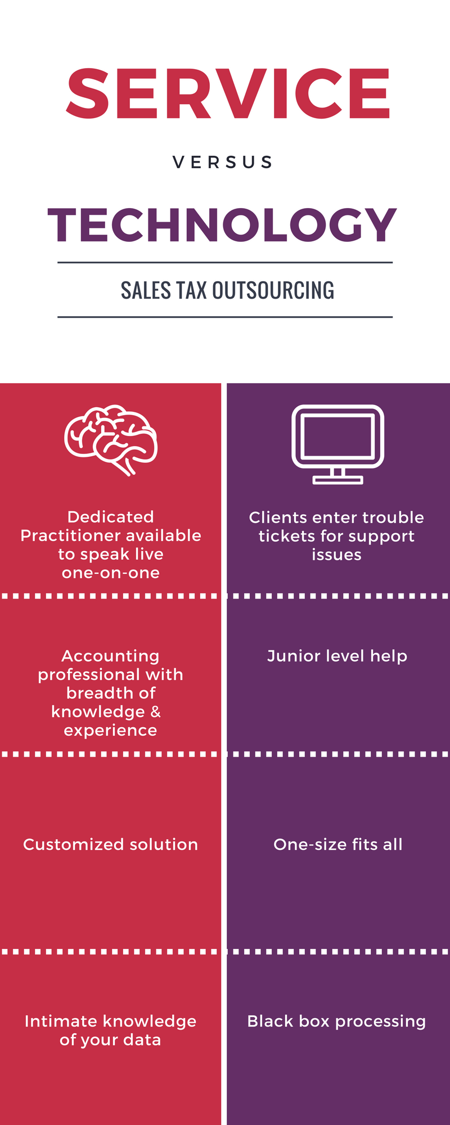

The infographic below shows the difference between the service-first approach and the technology-first approach as it relates to sales tax compliance outsourcing.

Tags:

sales tax compliance

Ever notice how the first characters in every horror movie never...

Copyright © 2025 TaxConnex, LLC