Your sales tax obligations depend on knowledge and that knowledge often resides in a professional tax specialist (usually an accountant) who helps your company meet its sales tax obligations.

3 min read

In ongoing accounting crunch, where to go for sales tax help?

By Robert Dumas on Tue, Feb 27, 2024 @ 11:00 AM

Topics: sales tax compliance sales tax CPA

2 min read

The Current State of Managing Sales Tax Obligations

By Robert Dumas on Tue, Feb 13, 2024 @ 11:00 AM

To help financial leaders better understand what their peers are doing when it comes to sales and use tax in 2024, TaxConnex® conducted its fourth annual sales tax survey in November of 2023. More than 100 financial leaders from different industries and from a wide range of sizes responded. Their responses are included in the following blog.

Topics: sales tax compliance sales tax CPA

4 min read

The Impacts of Managing Sales and Use Tax Obligations on Financial Professionals – Our 4th Annual Survey Results to be Released

By Robert Dumas on Tue, Jan 09, 2024 @ 11:01 AM

We are excited to announce the completion of our fourth annual sales tax survey.

Topics: sales tax compliance sales tax CPA

3 min read

Don't Forget Sales Tax When It Comes to Year-End Planning for Your Clients!

By Robert Dumas on Thu, Nov 02, 2023 @ 11:00 AM

Topics: sales tax compliance sales tax CPA

4 min read

5 Reasons to Outsource Your Sales Tax Compliance Process

By Robert Dumas on Tue, May 16, 2023 @ 11:00 AM

As you are likely aware, managing your sales and use tax obligations is not a small task. Ensuring you have the right people and processes in place is key to maintaining compliance and not putting yourself or your business at risk.

Topics: sales tax compliance sales tax CPA

1 min read

TaxConnex Wins ClearlyRated's 2023 Best of Accounting Award for Service Excellence

By Robert Dumas on Tue, Apr 25, 2023 @ 11:00 AM

We are excited to announce that we have won the Best of Accounting Awardfor providing superior service to their clients. ClearlyRated's Best of Accounting® Award winners have proven to be industry leaders in service quality based entirely on ratings provided by their clients.On average, clients of 2023 Best of Accounting winners are more than 1.7 times as likely to be satisfied than those who work with non-winning firms. TaxConnex received satisfaction scores of 9 or 10 out of 10 from 90.8% of their clients, significantly higher than the industry’s average of 50% in 2022.

Topics: sales tax compliance sales tax CPA Now it's all on us

5 min read

How to address growing skills gap for sales tax compliance

By Robert Dumas on Tue, Mar 21, 2023 @ 11:13 AM

The use of internal resources still seems the way to go for most companies struggling to meet their sales tax filing and remittance obligations. But for how long?

Topics: sales tax compliance sales tax CPA

3 min read

The Big 3 Barriers to Managing Sales Tax

By Robert Dumas on Thu, Feb 16, 2023 @ 11:00 AM

Think you’re the only one worried about sales tax compliance? According to our third annual Sales Tax Market Survey you’re not.

Topics: sales tax compliance sales tax CPA

4 min read

What to know about responsible party laws

By Robert Dumas on Thu, Jan 19, 2023 @ 11:24 AM

We hear a lot about “sales tax obligations,” but who exactly in your company is “obligated?”

You are, at least in many states.

Topics: sales tax compliance sales tax CPA

2 min read

3rd Annual Sales Tax Market Research Survey Results Released!

By Robert Dumas on Tue, Jan 10, 2023 @ 11:00 AM

We have completed our third annual survey of top financial professionals on how they are managing sales tax. This year’s results reveal a perfect storm is brewing for financial leaders who continue to depend on internal resources even though expertise and bandwidth is lacking while companies struggle with the current economic climate, rising inflation, and a tight job market.

Topics: sales tax compliance sales tax CPA

2 min read

Accounting firms and sales and use tax advising: Perfect together?

By Robert Dumas on Tue, Nov 22, 2022 @ 02:05 PM

In our blog last week, we looked at how sales and use tax advisory services might be a good new field for CPAs and accounting firms. How can they go about making the move?

Topics: sales tax compliance sales tax CPA

2 min read

Can accounting firms move into sales tax advising?

By Robert Dumas on Tue, Nov 15, 2022 @ 11:00 AM

Many certified public accountants (CPAs), enrolled agents and other tax preparers and professionals that run accounting and tax preparation firms are constantly looking for new advisory avenues to service clients.

Topics: sales tax compliance sales tax CPA

1 min read

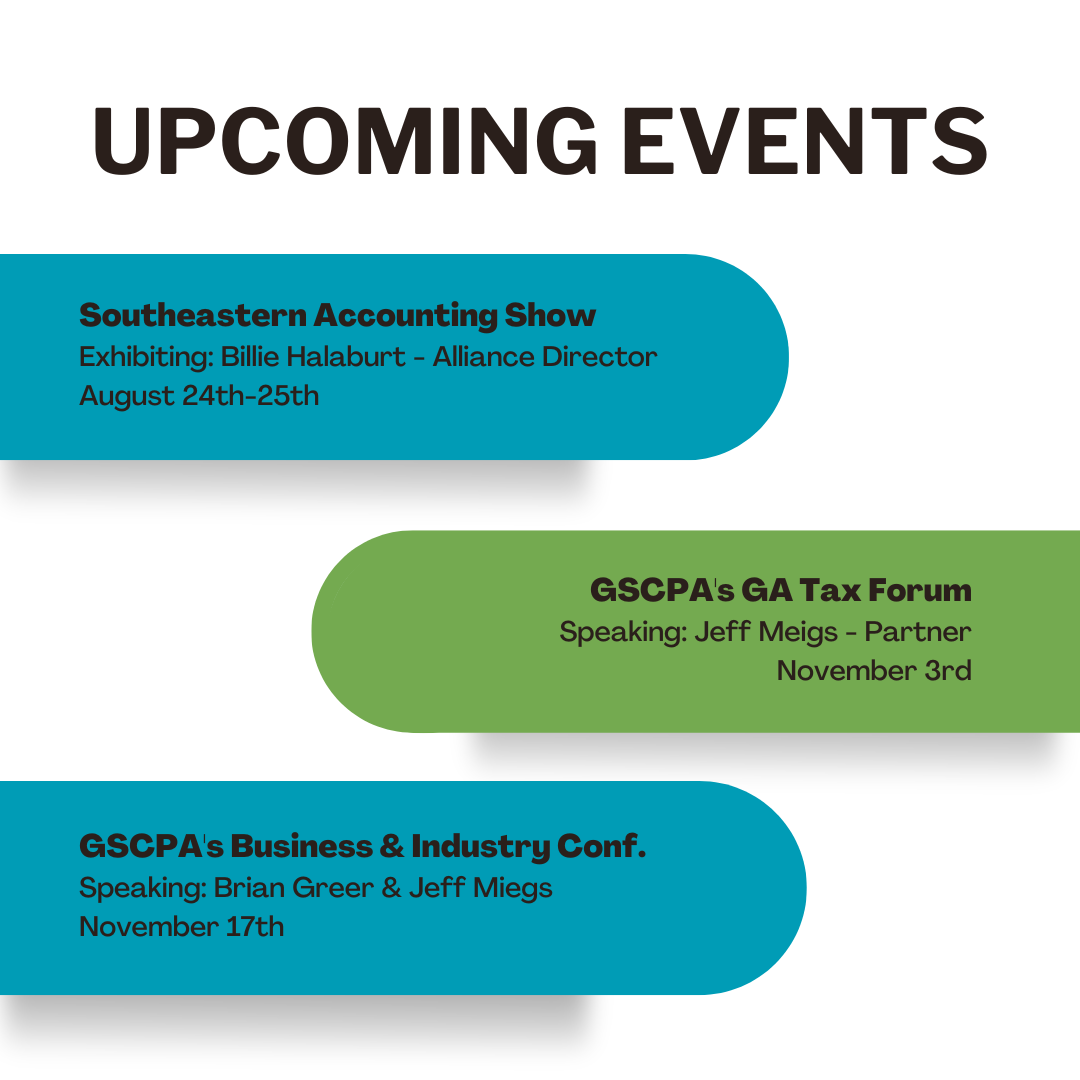

TaxConnex® Chosen to Speak at Two GSCPA Events This Fall and Exhibiting this Week at the Southeastern Accounting Show!

By TaxConnex® on Tue, Aug 23, 2022 @ 02:12 PM

We are excited to announce that we have been chosen by the Georgia Society of CPAs to speak at two events this fall and exhibit at this week’s Southeastern Accounting Show!

Topics: CPA Now it's all on us events

1 min read

Sales and Use Tax Compliance - Deadlines, Deadlines and More Deadlines

By Robert Dumas on Wed, Aug 26, 2015 @ 09:53 AM

'Tis the season…and it never seems to end. We have been communicating with many CPA firms during the month of August regarding numerous client issues and partnering opportunities. Almost without exception, the firms we contacted indicated they did not have the capacity to do anything new until after the September 15 and October 15 income tax deadlines. This is indicative of the life of most CPAs. We schedule our lives around a never-ending list of deadlines.

Topics: sales tax compliance CPA

2 min read

Helping CPA Firms Identify Sales and Use Tax Risks

By Robert Dumas on Tue, Aug 04, 2015 @ 11:30 AM

In my last blog, I discussed the opportunity CPA firms have to use sales and use tax issues as a way to add value to their clients and further cement the relationships and related revenue stream. As promised, this blog provides the following action items for identifying sales and use tax risk with your client:

Topics: sales tax sales tax audits CPA

1 min read

Helping CPA Firms Secure Their Relationship Through Sales Tax Services

By Robert Dumas on Thu, Jul 16, 2015 @ 10:00 AM

Throughout my career, I have worked in and with CPA firms of all sizes. For the most part, they all have similar business models that are heavily dependent on their client relationships. The CPA firms and the individual CPA’s within the firms need to continually prove their value in the relationship by exceeding client expectations, which guarantees the relationship and related revenue remain secure. One of the ways a CPA can exceed expectations is by offering solutions to unidentified client risks and problems.

.png?width=1200&height=628&name=2023%20logo%20with%20SOC%20and%20clearly%20rated%20(2).png)